Legally Leveraging Crypto Hacks For Gains

While cryptocurrency project exploits are unsavoury, my recent experience showed that there's an opportunity to legally make gains on the resulting price volatility.

Cryptocurrency Price Opportunities Resulting From Hack Attacks.

This article is by no means financial advice. It is not an excuse for impulsive behaviour or entry into get-rich-quick schemes. However, hacks in the crypto industry present ample opportunities for quick and potentially long term gains if one plays their cards correctly.

One of the largest 'hack heists' in history occurred on the Poly Network in the week commencing Sunday, August 8th.

For comparison, the largest bank heist in history occurred during the US invasion of Iraq in March 2003. Saddam Hussein's son oversaw the removal of nearly $1 billion worth of cash and assets from the Central Bank of Iraq.

The Poly Network is a cross-chain interoperability infrastructure integrating Bitcoin, Ethereum, Neo, Ontology, Elrond, Zilliqa, Binance Smart Chain, Switcheo and Huobi ECO Chain. The network was compromised earlier this week, with the hacker making away with a whopping $611 million.

The hacker has returned almost all of the funds prompting the network operators to classify the hack as a 'white hat' attack. This term refers to ethical hacking, where the hacker finds exploits for the greater good. Some other networks and projects were not so lucky in comparison. In February of 2021, the decentralised finance (Defi) insurance platform Armor finance offered a white hat hacker $1.5 million worth of tokens. The hacker discovered an exploit that would have resulted in a potentially malicious actor draining the project's underwriting funds.

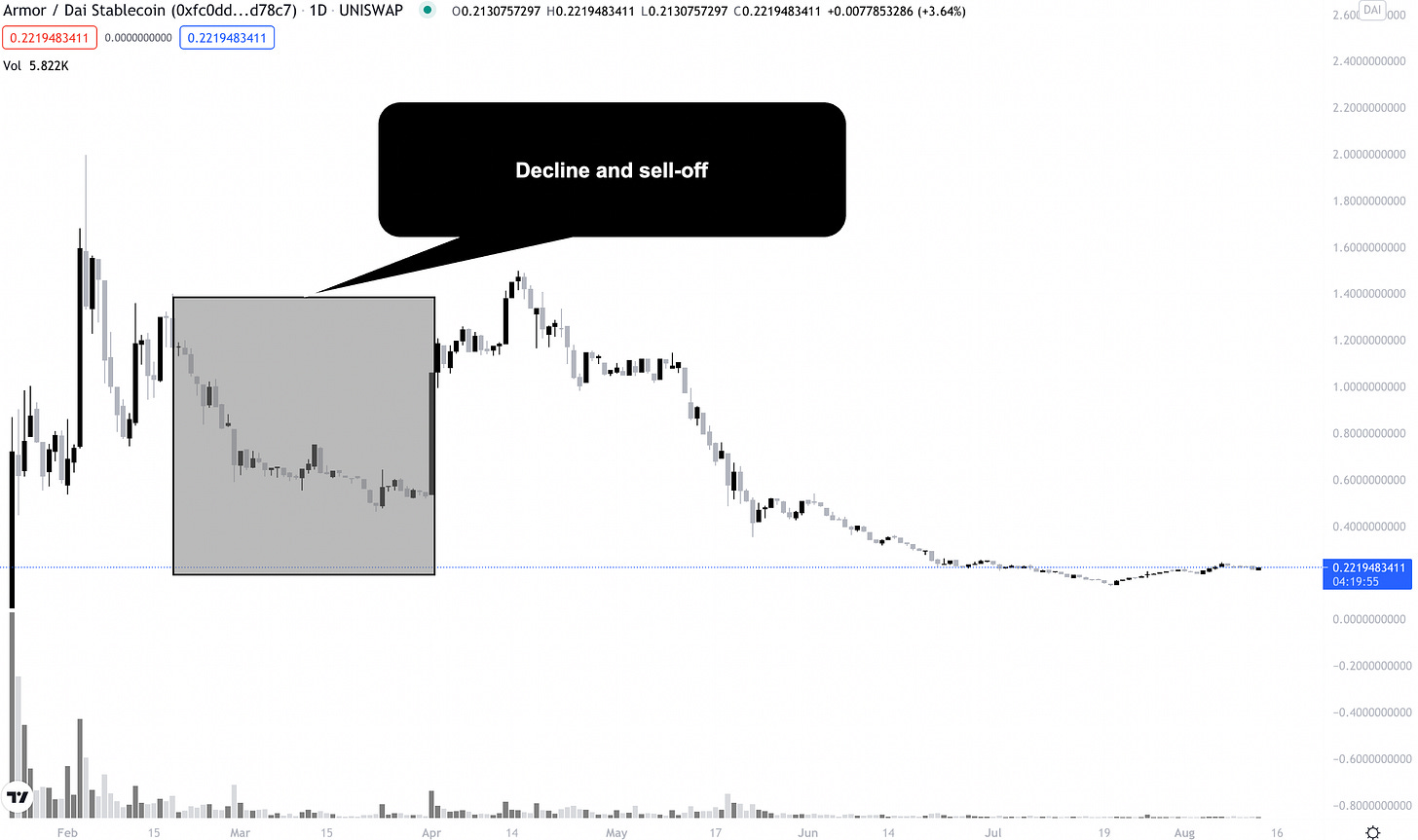

Additionally, the project's Twitter handle confirmed on February 28th that a sophisticated social engineering scam resulted in the loss of 1.2 million Armor tokens from a team member. While this was not a hack per se, the market price of Armor tokens took a significant hit (see Figure 1). While the token's price experienced volatility towards the downside, news of the scam prompted a sell-off.

Figure 1: Armor Finance Scam And Subsequent Sell-off

Similarly, THORchain, a decentralised liquidity protocol, suffered an $8 million hack on July 29th. This recent hack occurred six days after an initial hack of around $6.9 million. There was negligible impact on the price, given that most projects were already experiencing low price points because of Bitcoin's (BTC) price correction (see Figure 2).

Figure 2: THORchain Hack And BTC's Price Correction

Finally, Bondly Finance, a project attempting to make Defi more accessible to everyday users through decentralised escrow payments and traditional marketplaces, suffered an exploit on the evening of July 14th 2021. The attacker minted over 370 million BONDLY tokens, selling many of them and causing their price to crash to more than 99% of their original value (see Figure 3).

Figure 3: Bondly Finance Hack And Price Crash

The ROI On Compromised Projects.

Note that it is impossible to perfectly time the bottoms and tops of markets without significant luck. Nevertheless, for Armor tokens, the market bottom occurred around $0.59. The market top occurred at approximately $1.50 on February 28th and April 15th, respectively. One would have seen a 2.5x ROI if one were able to time the market.

Similarly, the current price of BONDLY tokens reached a seven-day low of $0.00255 and a high of $0.01484, as of August 13th, a 5.8x ROI. Remember that the project team continuously warns would-be traders and investors to refrain from trading the compromised tokens. More so, the project team are looking to redeploy tokens at a later time.

Compromised Projects Are Not For The Faint-Hearted.

This article does not condone cryptocurrency exploits and understands that these exploits cause real-world financial harm. Perhaps there is an opportunity in the chaos - if one can time the market just right, which is extremely hard. This article does not encourage readers to take advantage of this opportunity as it may be illusory. It aims to highlight 'what could have been' were one to take advantage of these unfortunate exploits.

On Thursday, August 12th, DAO Maker, a project providing scalable technologies and funding support to tokenised startups, experienced an exploit to the tune of $7 million. The price impact of this unfortunate hack has not materialised prominently compared to the ones mentioned above. The project's token experienced a price bottom of about $1.6563 on August 12th and is currently trading at $2.1900 at writing. This price strength is because of the current bullishness of the crypto market, which is quite unhealthy for a market recently beleaguered by negative news and government oversight.

Finally, do not invest or trade exploited tokens. These exploits cause real-world harm to individuals.

Please follow me on Twitter for more market insights and general shitposts.